Frequently Asked Questions (FAQ)

FAQ

Membership

Q: Who is considered an SERS member?

A: By law, all non-teaching employees of Ohio’s boards of education, school districts, vocational and technical schools, community schools, and community colleges are required to contribute to SERS.

Q: Do contracted services need to contribute to SERS?

A: If a person performs a service common to the normal daily operation of a school even though the person is employed and paid by one who has contracted with an employer to perform the service, that person is considered an employee and must contribute to SERS.

Hiring contracted services does not necessarily relieve the obligation of SERS membership. If there is a question about a contracted position and membership to SERS, please contact Employer Services for a determination.

Please see the Membership Fact Sheet for more information.

Q: I am not sure if an employee should be a member of SERS. What should I do?

A: Request a determination from SERS. Employer Services will need a copy of the job description and/or contract, and a completed Membership Determination Form (EMP-7010). Once SERS has reviewed your request, you will receive a membership determination.

Q: I disagree with the initial determination given by SERS staff. What should I do?

A: Contact SERS. Staff will ask you to provide additional information. Once we receive the additional information, staff will review it and provide a determination.

If the district disagrees with the final determination, a request can be submitted to bring it before SERS’ Board of Trustees. The Board will review the request and provide their determination. All determinations provided by the Board are final.

Q: Who is exempt from membership?

A: Employees who may choose exemption include:

- A student who is not already a SERS member at the time of employment, and who is employed by the school or college in which the student is enrolled and regularly attending classes

- An emergency employee serving on a temporary basis in the event of a flood, fire, snow removal, earthquake, or other similar emergency

- An individual employed in a program established under the federal Workforce Investment Act or any other federal job training program

Q: How long should I keep a Request for Exemption from Membership form?

A: You should keep the exemption form indefinitely. If an individual contacts SERS to establish service credit for this service, you are required to provide a copy of this form to SERS. If you are unable to present a copy of the signed form, you may be responsible for paying the employee and employer contributions as well as any possible interest.

Q: What if a coach previously held a teaching license, but the license lapsed?

A: Membership for coaches and athletic directors is based on whether the member currently holds a valid Ohio Department of Education and Workforce teaching license. If the individual is no longer licensed, membership should be switched from STRS to SERS.

Q: Can a board member change their mind about contributing to SERS?

A: Once a board member has chosen to contribute to SERS, that decision is irrevocable while the board member continuously holds office. If the board member sits out for a term and is reelected, he or she can then choose to contribute to either SERS or Social Security.

Member Enrollment

Q: How do I enroll my new SERS employees?

A: Enter all new employees, including reemployed retirees, through eSERS using either the Upload Enrollment Files or Manual Enrollment Entry option.

Q: I entered a new member’s start date incorrectly. Should I enter a new membership record?

A: No, do not enter a new membership record. Call Employer Services at 1-877-213-0861 or email employerservices@ohsers.org for help with making a correction to your member enrollment.

Q: I entered a membership record with a wrong Social Security number. What should I do?

A: Call Employer Services. We will require that you send a copy of the Social Security card or a copy of the I9 in order to correct the record. You may need to enter a new enrollment with the correct Social Security number (SSN).

Q: I have a board member that I only pay once a year. Will I need to enroll them every year?

A: Yes. If a member has not worked or been paid within the last six months, then a new enrollment will need to be entered.

Q: I am not sure if I entered a membership record. How can I tell if an employee was entered?

A: Choose the Employer Reporting Detail Lookup application on eSERS, enter the search criteria (SSN, and first and last names), and click search. Under the search results, you will see if an enrollment or transposed number was entered.

Q: Does SERS still need a copy of the SSA Form?

A: Federal regulations require employers to submit a Statement Concerning Your Employment in a Job Not Covered by Social Security Form (SSA-1945). The form explains how public employment may affect Social Security benefits. You must submit a copy to SERS once it has been signed by the employee.

SSA-1945 forms can be submitted using the SSA-1945 upload option on eSERS, faxed to 614-340-1195, or mailed to SERS. For security purposes, please do not email the SSA-1945.

Q: Do I need to enter a membership record for my contracted service employees?

A: If a person performs a service common to the normal daily operation of a school even though the person is employed and paid by one who has contracted with an employer to perform the service, that person is considered an employee and a membership record will need to be entered into eSERS. This is done by the employer or the contract company if given permissions on eSERS.

Q: Is a membership record required prior to submitting a contribution file?

A: Yes. Member enrollments need to be entered into eSERS prior to submitting your contribution file.

If a member enrollment is not entered prior to submitting your contribution file, you will receive an error on your report, and you will need to enroll your employee prior to posting the contribution file. At that time, you can manually enter the member enrollment using the Upload Enrollment Files or Manual Enrollment Entry option in eSERS.

You must go to the individual’s contribution record that is in review and click save for the enrollment error to be removed.

Compensation

Q: What is considered compensation?

A: “Compensation” includes all salary, wages, and other earnings paid to an employee by reason of employment.

Q: What compensation is subject to SERS contributions?

A: Compensation subject to SERS contributions includes, but is not limited to:

- Regular base salary

- Regular/base hourly wages

- Overtime paid to non-exempt employees

- Pick-up on Pick-up Plan

- Pay for used vacation and sick leave

- Paid holiday

- Calamity days

- Across-the-board retroactive wage settlements

- Longevity/length of service, which is a payment based on total years of employment per written contract or policy and applicable to all employees

- Merit increases

- Employe payments to an eligible retirement plan (e.g. 403(b), 457(b), 401(k))

- Backpay award that reinstates an employee to the employee’s position without interruption of loss of time

- To avoid any interest accrued, the payment will need to be submitted within the same fiscal year it was earned/paid.

- Extended days

- Commissions per contract terms

- Payments made by the employer to the employee for Workers’ Compensation Salary Continuation

- Lump sum payments

- Must be provided for in the collective bargaining agreement, individual contract, or school district policy

- Retention payments

- Must be written in the contract

- Education payments

- Must be written into a contract or school district policy

- Signing bonus

- Must be written into a contract or school district policy

Q: What compensation is not subject to SERS contributions?

A: Compensation not subject to SERS contributions, includes, but is not limited to:

- Unused compensatory time (comp time) cash out

- Unused leave time (vacation/sick/personal) cash out

- Attendance, which are payments for limited use of sick leave per a policy or contract

- Wellness rewards, which are payments to employees for achieving measurable health goals as set forth in a written policy

- Recruitment, which is a payment for referring a job applicant who is hired

- Severance payment

- Bonus payment, which is a discretionary payment not governed in a contract

- Amounts paid to an employee for life insurance, sickness, accident, endowment, health, medical, hospital, dental, or surgical coverage or in lieu of providing insurance

- Incidental benefits including lodging, food, laundry, clothing/uniform allowance, and parking

- Services furnished by the employer, including use of the employer’s property or equipment, and cell phones

- Reimbursement for job-related expenses authorized by the employer, including moving and travel expenses related to professional development

- Compensation made on behalf of an employee exceeding the allowable limit under federal tax law

- Anything of value paid to an employee based on or attributed to retirement or an agreement to retire.

- Payments made as a differential payment for an employee who enters active military duty for mor than a month

Q: An employee received a grievance settlement. Should compensation be withheld from that payment?

A: All settlements must be reviewed by SERS prior to remitting contributions. SERS requires a copy of the settlement agreement to Employer Services. Upon review, you will receive a determination regarding compensation.

If it is determined that the settlement is considered SERS compensation, the payment will need to be reported within that fiscal year to avoid interest.

Q: Is a payment to a “tax-sheltered annuity” considered compensation for purposes of SERS?

A: Administrative Rule 3309-1-02(C)(1) states that payments on behalf of a contributor to an eligible retirement plan as defined in section 402(c)(8) of the Internal Revenue Code are considered compensation.

The following are eligible retirement plans under 402(c)(8): a 408(a) individual retirement account, a 408(b) individual retirement annuity, a qualified trust, a 403(a) annuity plan, a 457(b) deferred compensation plan, and a 403(b) annuity contract.

If the “tax-sheltered annuity” is an eligible retirement plan under 402(c)(8), it is considered compensation for purposes of SERS.

Q: I am not sure if a payment should have contributions withheld. What should I do?

A: When a question exists as to whether a payment is subject to SERS withholding, the employer should request, in writing, a determination from SERS. A request should be submitted prior to the payment being issued to the member.

Reporting of Contributions

Q: When is my contribution report due to SERS?

A: Your contribution report is due to SERS no later than five business days after each pay date in eSERS.

Q: How do I determine my pay date?

A: Due dates are determined by payroll schedules entered by the district.

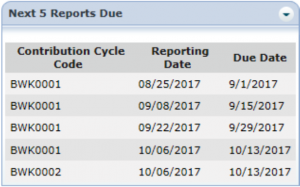

To help stay on top of payment and reporting due dates, refer to the Next 5 Reports Due panel on the eSERS Home Page. This panel lists the due dates based on the contribution cycle code and corresponding reporting date. These dates are taken from the payroll schedule that was entered by the district.

Q: How do I report contributions to SERS?

A: Contributions are reported through eSERS by using either the Upload Contribution File or Manual Contribution Entry application.

For further information, refer to the eSERS Guide – Contribution Reporting.

Q: What is the current contribution rate for employees and employers?

A: The employee contribution rate currently is 10%.

The employer contribution rate currently is 14%.

Q: Is the school district responsible for contractor reporting?

A: Yes. The district is responsible for confirming contractor reporting and payments are completed and submitted to SERS no later than five business days after each pay date in eSERS. If the contractor’s reporting or payment is late, the district will accrue the penalty.

Q: Can I report my supplemental employees in my regular payroll file?

A: Yes. Coaches and supplemental employees can be submitted with your regular payroll file if they have the same pay date as your regular employees.

The supplemental earnings code is used.

You can find further information on contribution reporting earnings codes here.

Q: How do I submit contributions for a prior fiscal year?

A: Contact SERS to find out the proper method for reporting prior year contributions.

Q: Can I view contributions previously submitted?

A: Yes, there are a couple ways to review previously submitted contributions in eSERS:

- You can search by a member’s Social Security number, member’s name, or the contribution file using the Employer Reporting Detail Lookup application. For more information on Employer Reporting Detail Lookup, see the eSERS Guide.

- You can open a previously reported file to view, or export to Excel using the Posted Employer Reporting Header panel in the Contribution File Correction and Manual Contribution application.

Payments

Q: Why is there a credit memo showing under my new payment remittance?

A: A credit memo is created when an adjustment posts to a member’s account.

You can use the credit memo against your liability, or you may request that the credit be refunded back to the district.

You can find further information on credit memos here.

Q: I posted my contribution file. How do I make a payment?

A: Once your contribution file has posted, a liability is created under the Payment Remittance application in eSERS. See the Payment Remittance section of the eSERS Guide for more information.

Q: I uploaded my contribution file and want to make a payment, but cannot find the liability in the Unpaid Liabilities panel on the Payment Remittance screen. Where can I find it?

A: Most likely, your contribution file has not posted. Look in the Contribution File Correction and Manual Contribution Entry application to see if your file is still in review status or has not been submitted for posting.

Q: Can I pay multiple liabilities on one payment remittance?

A: Yes. Just put a checkmark in the box beside the liabilities you want to pay, then click Add Selected to Pay. See the Payment Remittance section of the eSERS Guide for more information.

Q: Do I need to apply my contractor’s credit memo for them?

A: Yes. For security purposes, contractors are not able to apply any credit memos they have generated. The district will need to apply contractors’ credit memos on their behalf.

Q: Should I use the expected liability option when making a payment?

A: No. There are only a few circumstances in which you should use the expected liability option.

If you are not sure if you should use this option, call Employer Services.

Q: How can I tell if my liability payment has been processed?

A: Look under the Payment Remittance History section of the Payment Remittance application.

Click on the payment remittance ID hyperlink to open the payment details. See the eSERS Guide for more information.

Q: Can I make a correction to or delete a payment remittance that was done in error?

A: Yes, as long as the payment is still in a pending status. You can either make a correction or void it.

Q: Can I make a payment on a liability using a check and an ACH debit in the same remittance?

A: No. Only one form of payment can be used for each payment remittance.

Adjustments

Q: What is an adjustment?

A: An adjustment is used to add or remove details to a previously submitted contribution record.

Q: How is an adjustment made?

A: All adjustments must be entered through eSERS.

Adjustments can be reported as part of an uploaded file with regular contributions or by manual entry. See the Adjustments section of the eSERS Guide for more information.

Q: When can an adjustment be made?

A: You may make an adjustment to the following:

- Contribution amounts

- Tax treatment of contributions

- Days reported

- Hours reported

- Reporting to the wrong retirement system

Q: Are there particular earnings codes that should be used for an adjustment?

A: Yes, you can find a list of earning codes and their definitions here.

Q: I didn’t pay an employee on a prior reporting period. How do I report that contribution to SERS?

A: A manual adjustment can be done.

See the eSERS Guide for more information or call SERS for assistance.

Employer Pick-up Plan

Q: What is a pick-up plan?

A: Federal tax law permits employers to pick up employee retirement contributions. There are no Ohio statutes or SERS rules governing the implementation of a pick-up plan of mandatory employee contributions.

In order to implement a pick-up plan, federal tax law requires an employer to adopt a written plan that specifies the following:

- Group of employees to be covered

- Method of pick-up

- Planned effective date

Employees in the covered group cannot opt out of the pick-up plan.

Q: What types of employer pick-up plans are there?

A: There are three pick-up plan methods:

- Salary reduction: Contributions are deducted from the employee’s salary, but are deferred for federal and state income tax purposes.

- Fringe benefit not included in compensation: Contributions are paid by the employer out of the employer’s funds. The contribution is not deducted from the employee’s salary.

- Fringe with pick–up included in compensation: Often referred to as a “pick-up on pick-up” plan. Contributions are paid by the employer and an additional contribution on the 10% also is paid. This plan provides for a higher salary for retirement purposes only, which will affect the pension amount.

Q: Can a school district adopt a retroactive pick-up plan?

A: No. Per IRS guidelines, SERS cannot accept retroactive pick-up plans.

Q: Do I need to notify SERS when a pick-up plan is changed?

A: Yes. SERS needs to be notified of any change to an existing plan.

Notification needs to be submitted in eSERS under the Pickup Plan application. For more information on Pickup Plan submissions, see the eSERS Guide.

Q: Where can I find an example of how to calculate pick-up-on-pick-up?

A: For examples of pick-up plans, see the Pick-up Plan Fact Sheet.

Q: How do I submit a pick-up plan to SERS?

A: After an employer adopts a pick-up plan in accordance with federal tax law, they must notify SERS using eSERS .

A pick-up plan can be submitted using the Pick-up Plan application.

Please refer to the eSERS Guide for more information.

Reemployed Retirees

Q: Who is a reemployed retiree?

A: A reemployed retiree is anyone who retired through a public retirement system such as STRS, SERS, OPERS, OP&F, or HPRS and returns to work in a position covered by any public retirement system.

Q: Are there restrictions for a reemployed retiree who returns to public employment?

A: Yes. To avoid forfeiting his or her retirement payment, a retiree must wait two months from the effective date of retirement before reentering public employment. If not, he or she will forfeit the retirement payment for each month worked during the two-month waiting period.

A reemployed retiree can work an unlimited number of days and receive unlimited earnings in a SERS-covered position.

Reemployed retirees’ contributions go into a reemployed annuity. These contributions do not affect their original retirement account.

Q: Is there any situation in which a retiree can immediately return to work after retirement and not forfeit pension payments?

A: If the retiree held multiple positions prior to retirement, they may continue working in the lesser-paying position(s) without forfeiting two months of pension payments.

Q: Do I do anything different when enrolling or reporting contributions for a reemployed retiree?

A: No. You will enroll a reemployed retiree as you do any new employee through eSERS. Once a retiree is enrolled in SERS, remit contributions in the same manner as you would for a non-retired employee.

Surcharge

Q: What is the surcharge?

A: The surcharge is an additional employer charge used exclusively to fund health care.

It is calculated at 14% of the difference between an employee’s annual compensation and the minimum compensation amount.

The surcharge is limited to 2% of each district’s total qualified SERS payroll, and is subject to a statewide limit of 1.5% of SERS’ eligible compensation.

This additional charge applies to any SERS members reported during the fiscal year, except reemployed retirees and those who died prior to July 1.

Surcharge payments are subject to penalties if submitted after the due date.

Q: What is the minimum compensation amount?

A: The minimum compensation amount is $30,000 for fiscal year 2024. This amount is determined annually by the System’s actuaries.

Q: Where do I find my surcharge report?

A: Once logged into eSERS, click on Surcharge application.

The surcharge application will give you a breakdown of the charge along with a list of employees who appear on the report.

Click Export to Excel to print the surcharge report.

Q: Who should show on my surcharge report?

A: SERS members reported during the fiscal year who earned less than the minimum compensation, except reemployed retirees and those who died prior to July 1, will be displayed on the surcharge report.

Q: How do I report exemptions?

A: For reemployed retirees or members who passed away during the fiscal year, email their name(s) and the last four digits of their Social Security number(s) to Employer Services at employerservices@ohsers.org.

Q: How can I pay my surcharge liability?

A: If your district is participating in the Foundation Program and chose to have the surcharge collected from its Foundation payments, SERS will automatically deduct the surcharge payment from your Foundation payment. Please refer to your Foundation Deduction notice if you are unsure if SERS is deducting your surcharge.

If your district is NOT having SERS deduct the surcharge from its Foundation payment OR you are a direct pay district, the surcharge amount to be paid will be located in the Payment Remittance application under the Unpaid Liabilities panel.

Please submit the surcharge payment in the same manner you would contribution payments.

If the district is not paying through the Foundation Program, the surcharge is due within 30 days of the surcharge report’s availability on eSERS.

For questions regarding your surcharge report and payment, please contact Employer Services at 1-877-231-0861 or employerservices@ohsers.org.

Penalties

Q: Can payroll schedules affect penalties?

A: Yes. A penalty is assessed from the active payroll schedule pay date in eSERS.

The payroll schedule created by the district tells SERS when to expect reporting and payment. If reporting / payment is not received within five business days of pay date in eSERS, that has been recorded in the schedule, penalties will be assessed. If there is a current pay date in a schedule that you are no longer using, call SERS to have it removed.

Q: How are penalties assessed?

A: A penalty is assessed whenever there is a late reporting or late payment submitted. The due date is no later than five business days after each pay date in eSERS, that was entered by the district. For additional information, please see the Penalties Fact Sheet.

Q: What is the penalty process?

A: A notification will be sent to the eSERS message board advising the district that it is in penalty status. If the Payment Remittance was missing, you will receive an email from an Employer Services representative. Once the missing item (late contribution reporting or late payment) is submitted, a penalty invoice will be issued to the Employer Web Administrator and Fiscal Officer for the district. To pay the penalty, the liability will be available in the Payment Remittance application.

Q: Is there a penalty on a late payment remittance?

A. Yes. A payment remittance is required with all payments. If SERS receives payment without a corresponding payment remittance, a penalty will be applied. Submitting a payment without a corresponding payment remittance is considered incomplete reporting.

Q: Should I use “Expected Liability” in the payment remittance application?

A: No. To ensure that the contributions are allocated to the liability, it is imperative that a payment remittance be properly completed. It is necessary to select the liabilities that are being paid with the deposit that is being made.

Remember: Report, Post, Pay

Report the file (upload or manual)

Post the file (correct any errors in file)

Pay for the file (choose the liability created from posting the file in payment remittance)

Q: Will SERS extend a due date if an emergency happens?

A: SERS may extend a due date for “good cause” if the request is received before a due date, but there is no allowance for one-time forgiveness after a due date.

Q: How do I know when a report is due to SERS?

A: To remain current with payment and reporting dates, refer to the Next 5 Reports Due panel on the eSERS Home Page. This panel reflects the next five reports due based on the Contribution Cycle Code and corresponding Reporting Date. These dates are taken from the payroll schedule that has been entered by the district. If there is an incorrect due date listed, contact Employer Services.

Q: What are the penalties for a late payment?

A: Employee and employer contributions are to be remitted to SERS no later than five business days after each pay date in eSERS.

You are penalized $100 per business day. This penalty accrues until the contributions are received by SERS. Employers who choose to make their employer contribution payments through the Foundation Program are always considered on time. The district is responsible for any late payments from contract companies.

Q: What are the penalties for late reporting?

A: Payroll (contribution) reporting is due no later than five business days after each pay date in eSERS.

You are penalized $100 per day for each business day past the due date you do not submit, complete, or correct contribution reporting information. This penalty cannot exceed $1,500 per report. The contribution report needs to be submitted and posted (not in review status) in order for the report to be considered on time. This includes the payment remittance. The payment remittance is due prior to, or concurrent with, every employer payment made to SERS. The district is responsible for any late reporting from contract companies.

Q: How can penalties be paid?

A: For employers using the Foundation Program, payment of the penalty may be deducted from employer contribution amounts.

For all other employers, the penalty liability will need to be paid in the payment remittance application on eSERS.

Q: If my payment is postmarked by the fifth business day from my pay date, but received later, will I still accrue a penalty?

A: Yes. The payment needs to be received in the SERS lockbox by the fifth business day from your pay date in order to be considered on time.

Q: What is the fastest and most convenient way to submit payments to SERS?

A: Electronically by:

- ACH Debit (preferred method) – Enrolling the district in ACH debit allows SERS to pull an electronic payment from the activated bank account on a specified date. To find out how you can sign up, please see the Bank Account Maintenance section of the eSERS Guide.

- Other EFT (ACH credit) – The district will need to refer to its bank to submit the payment to SERS electronically. For wiring instructions, contact Employer Services.

Q: If my file was in review status and it posted after the due date, will I still accrue a penalty?

A: Yes. Any errors or warnings must be addressed, and the file needs to be posted within the five–business-day time frame in order for it to be considered on time. Once a report has posted, it will automatically create a liability to be paid in the payment remittance application.

Q: If a school district pays all employer contributions through the Foundation Program, will it be subject to the employer contribution penalty?

A: No. Foundation Program deductions are based on estimates and adjusted periodically. Employers that choose to make their employer contribution payments through the Foundation Program are always considered on time.

Q: What additional late payment penalties can be assessed to an employer?

A: Late payment penalties can be assessed to an employer for late payments to the Employer Trust Fund for Surcharge, the Annual Employer Statement Balance, Service Credit Purchase (SCP), and Early Retirement Incentive (ERI). Each of these payment types has its own set of due dates.

You will be penalized $100 per each business day that you do not transmit any amount due to the employer’s trust fund on time.