SERS’ Statewide Economic Impact

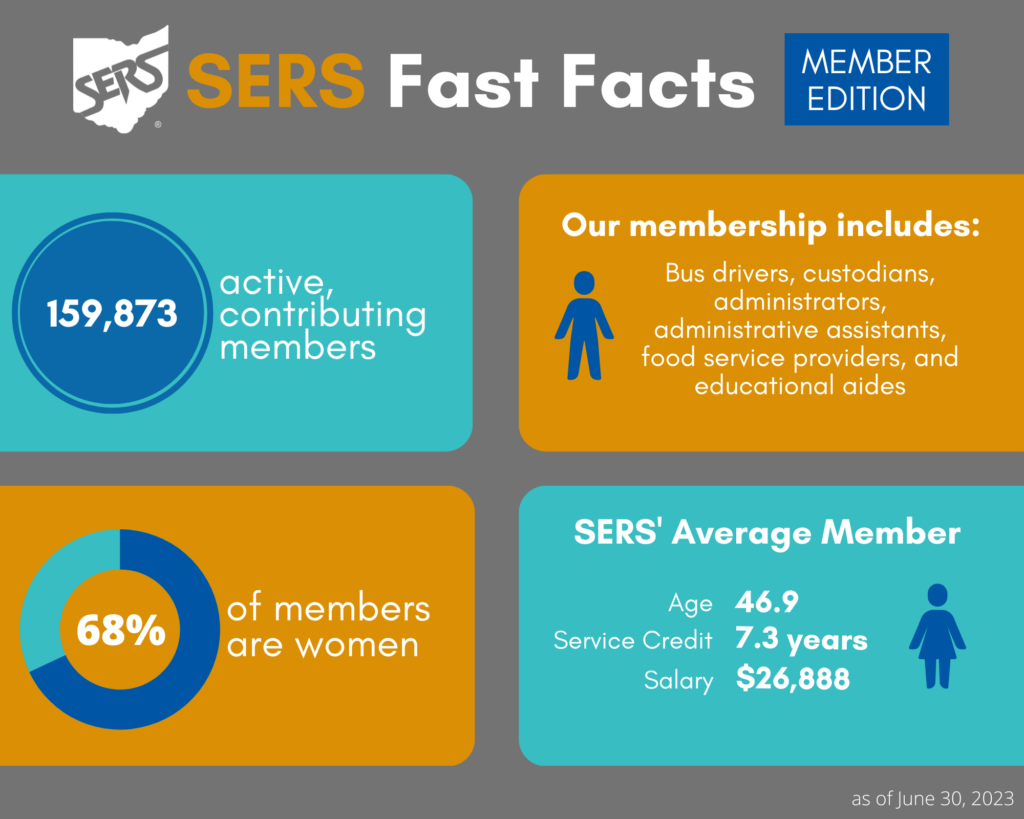

SERS provides retirement security for Ohio’s non-teaching school employees, including administrative assistants, bus drivers, food service workers, librarians, maintenance personnel, teacher aides, and treasurers. For their service, they receive reliable pensions that are spent locally on groceries, health care, and other goods and services.

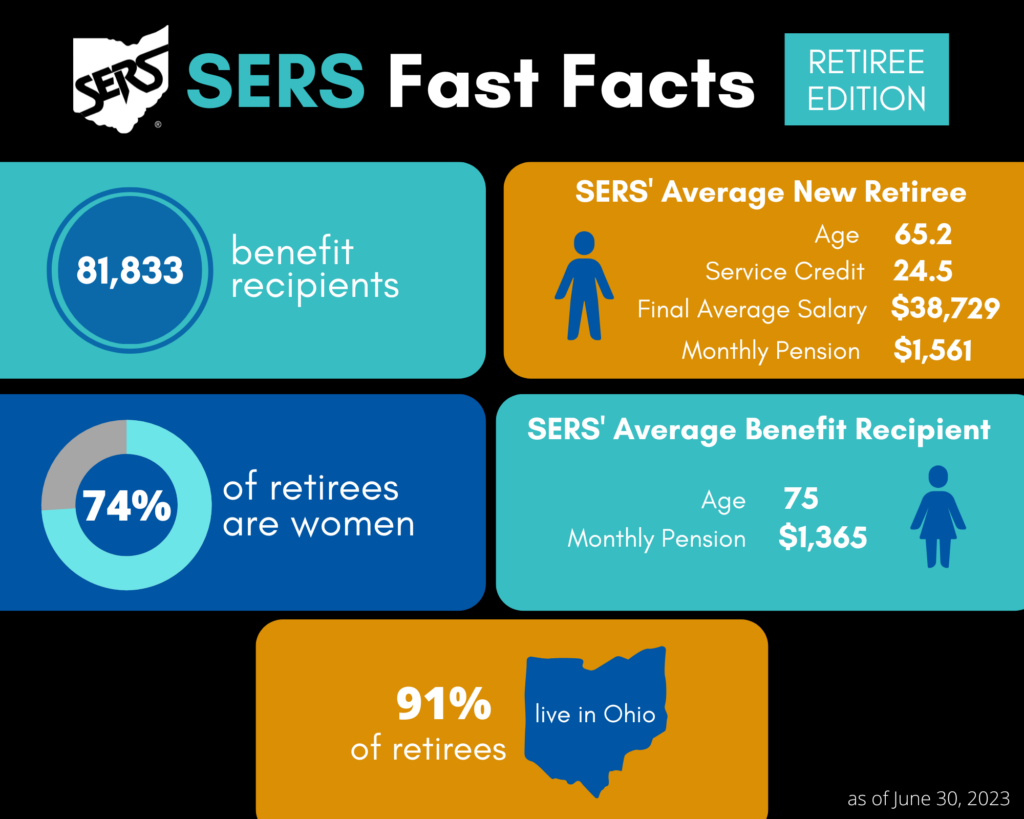

Of the 82,490 individuals receiving pension benefits from SERS, 91% live in Ohio. In FY2024 alone, pension benefit payments exceeding $1.29 billion were distributed among Ohio’s 88 counties, positively impacting the state’s economy.

To see how much SERS returned to each county in the form of pension benefits, take a look at our SERS Pension Benefits by County handout.