CBBC Explained

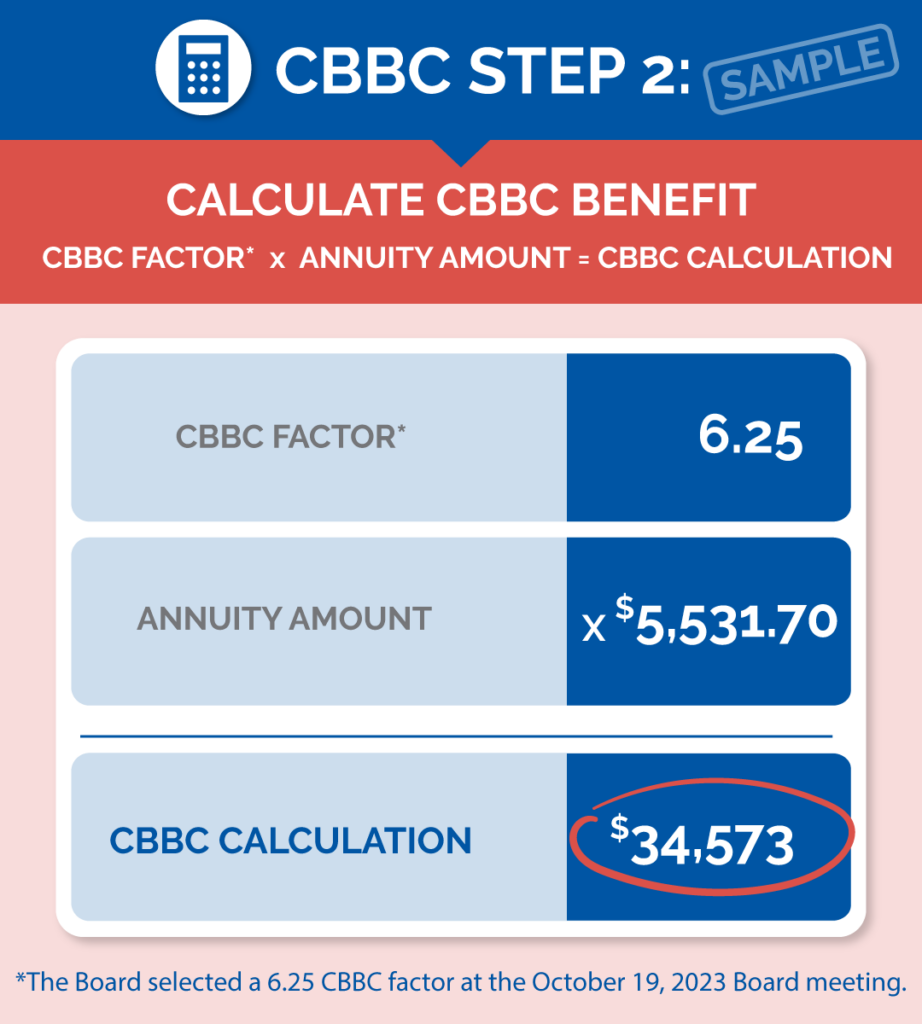

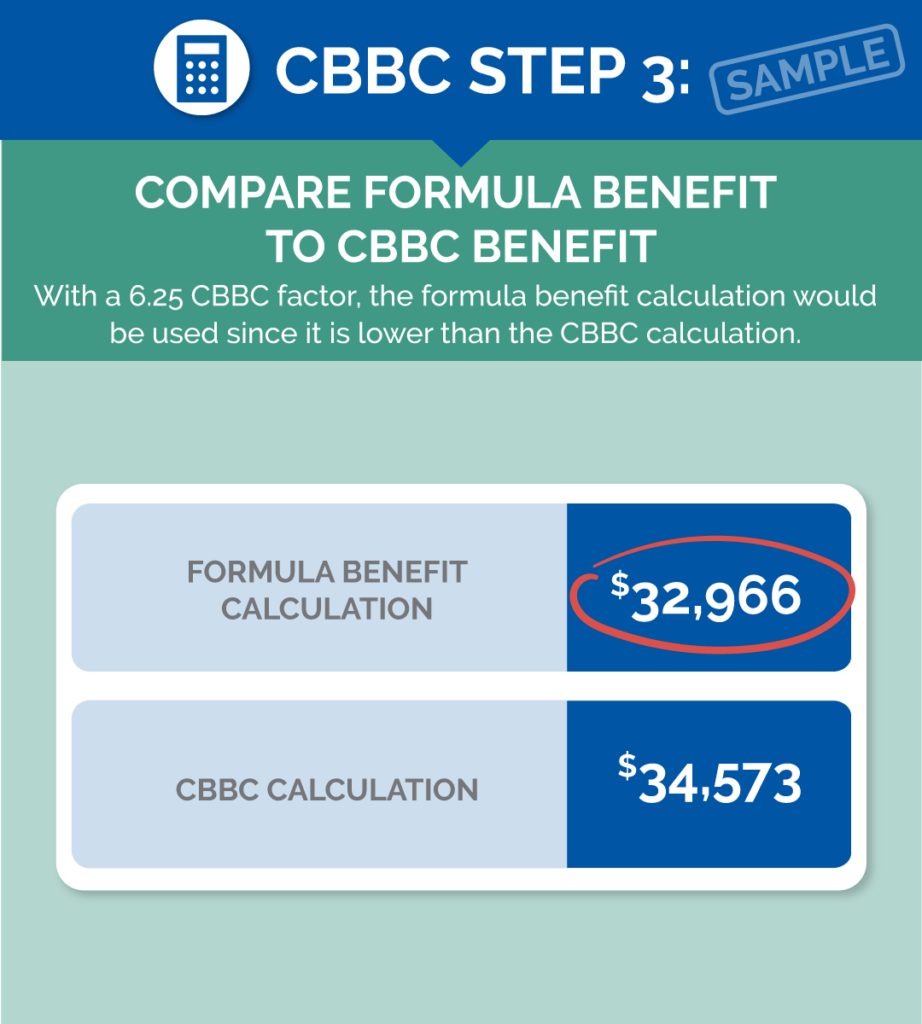

Effective August 1, 2024, the CBBC factor is set at 6.25.

The Contribution Based Benefit Cap (CBBC) is a tool SERS will begin using August 1, 2024, to identify and prevent pension spiking, or benefit inflation. While this is uncommon at SERS, when it does occur, the pension fund must subsidize those pensions, which is unfair to the majority of members whose career salary and contributions followed a normal trajectory.

Benefit inflation may occur when the highest three years of a member’s salary history is considerably higher than the rest of their working career. This results in a traditional pension calculation that is significantly higher than what is supported by their career contributions. The CBBC is fair for all members and ensures that a member’s career contributions support their pension benefit.

The CBBC calculation is independent of the traditional formula calculation and focuses only on a member’s career contribution history. The CBBC does NOT affect or change the Final Average Salary (FAS) calculation (average of the highest three years of salary) used in the traditional formula calculation.

The CBBC implementation does NOT affect anyone with a retirement effective date before August 1, 2024. The CBBC will NOT be applied to a disability conversion retirement allowance that is capped at 45% of the member’s FAS.

How will I know if I’m affected?

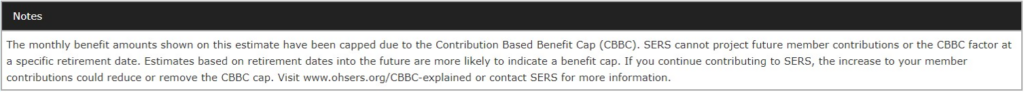

To determine if the CBBC will impact you, create a service retirement estimate in Account Login. After you have entered all required information, on the final estimate screen, you will see the following note if your benefit will be capped by the CBBC. If you do not see the following message, based on the entered information, you will not be affected by the CBBC.

Please note: SERS cannot project future member contributions, so estimates based on retirement dates further into the future are more likely to indicate a benefit cap. If you continue contributing to SERS, the increase to your member contributions could lessen or remove the CBBC.

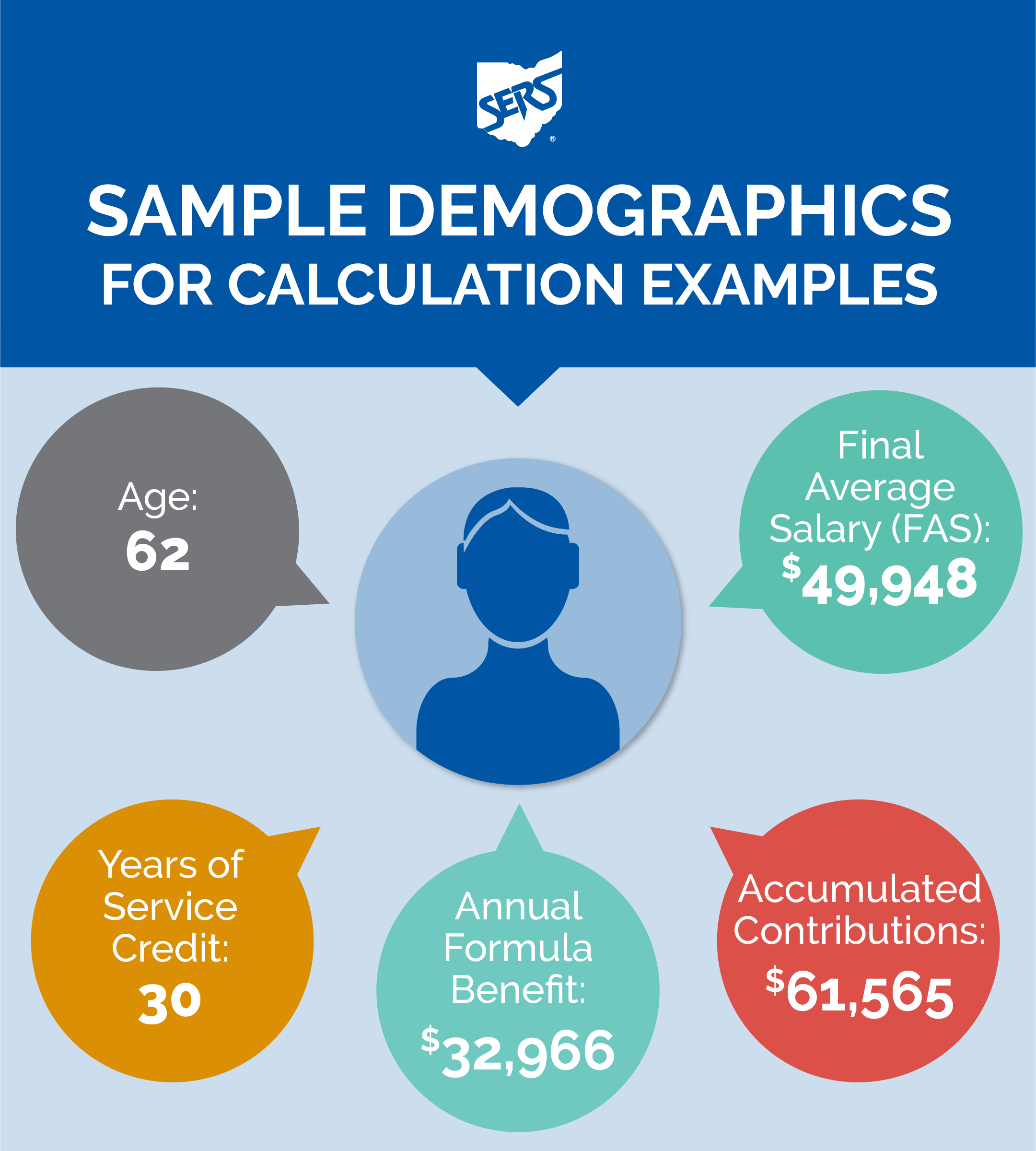

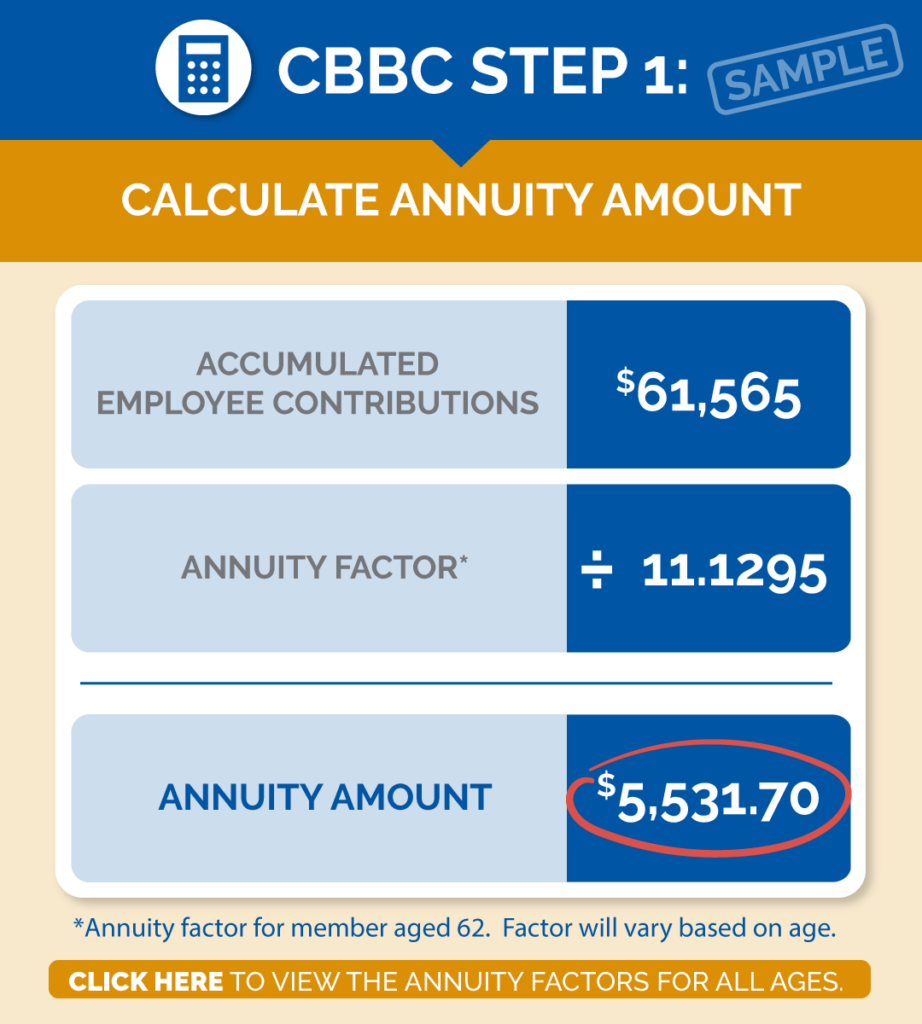

Below, we explain the CBBC calculation and how it will be used. The traditional formula benefit will be used in the majority of pension calculations and only a few situations each year will trigger a CBBC reduction.

Full Career, Regular Raises

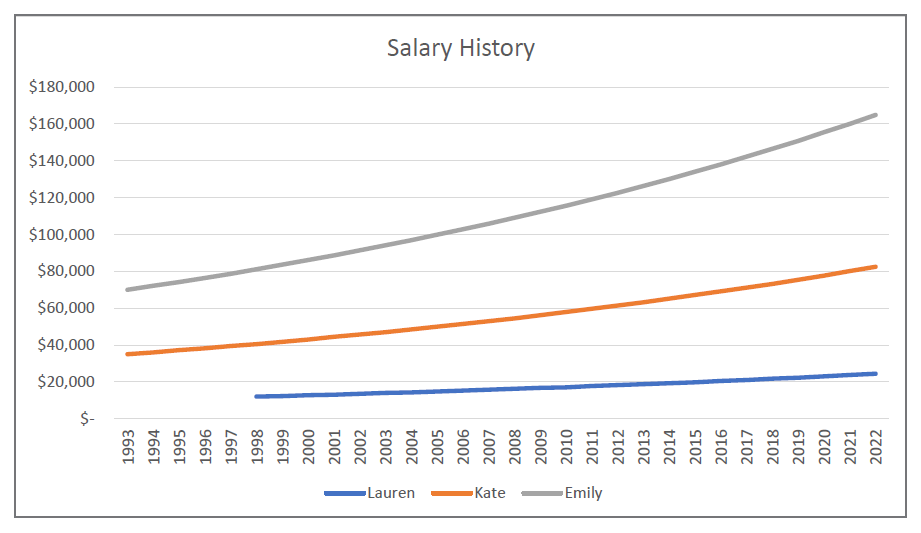

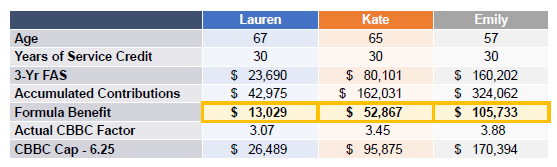

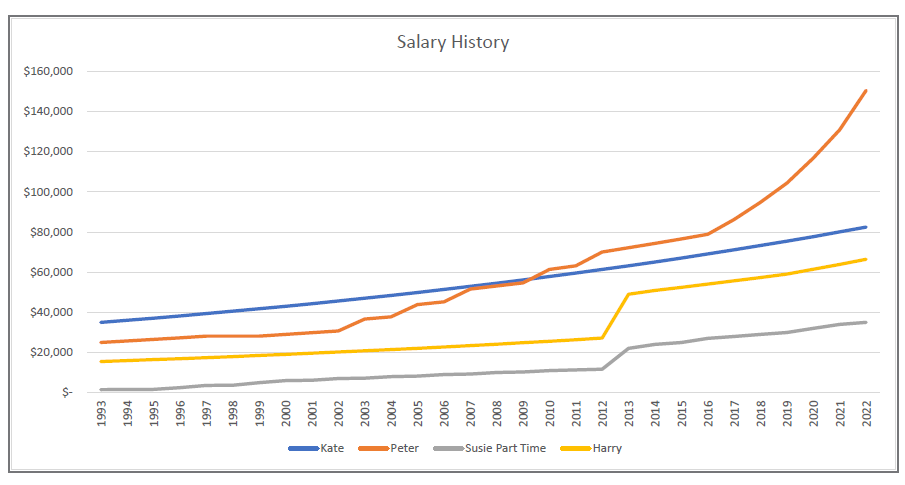

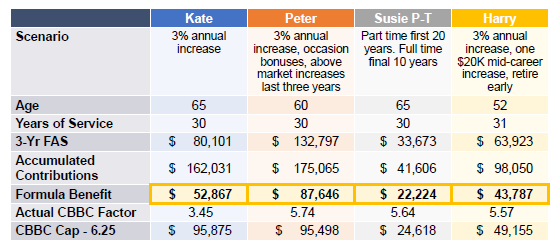

This scenario reflects three members with different salaries, but they all received the same 3% salary increase annually over their 25-30 years of service.

Members with normal salary increases adequately contribute toward their formula benefit. However, members should consider their age at retirement when planning for retirement, as younger retirement ages can lead to incremental increases in their CBBC factor.

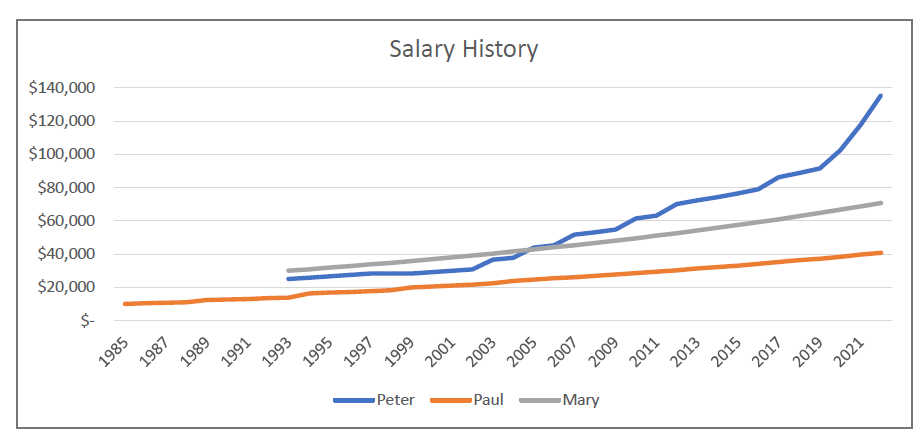

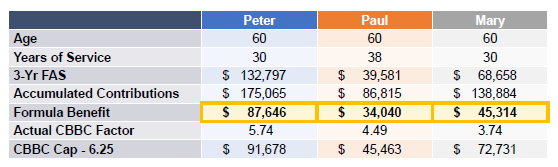

Full Career, Above-Market Raises

In this scenario, we have three members of the same age with various years of service. Peter’s salary history reflects a 30-year career with varying changes in salary including periods of steady increases, no increases, various bonuses, and above market salary increases near the end of his career. Paul’s salary history reflects a 38-year career with steady salary increases. Mary’s career, while shorter, also reflects steady salary increases.

While Peter’s salary increases near the end of his career increased his personal CBBC factor, his benefit would not be capped with a CBBC factor of 6.25.

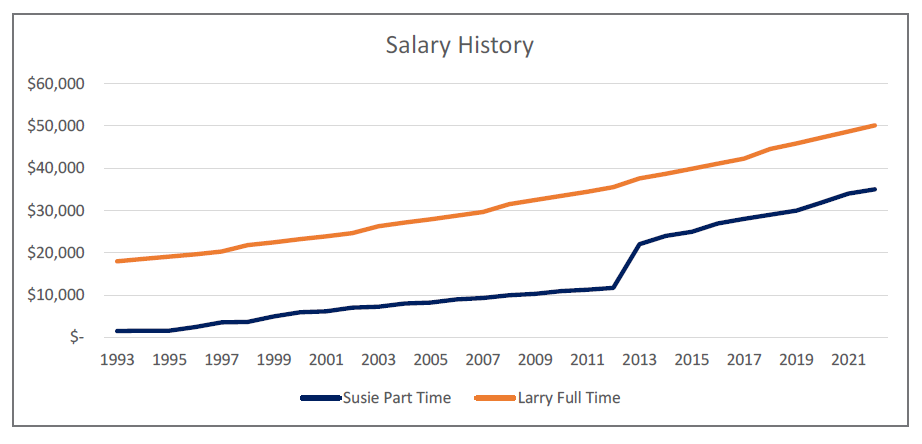

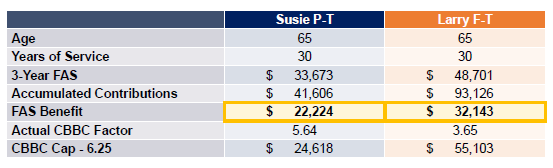

Part Time vs. Full Time

In this scenario, we have one member, Susie P-T, who worked part time while her children were in school. Once they graduated, she switched to full-time hours. Larry F-T worked full time his entire career, receiving normal salaries increases.

While Susie’s switch to full-time work during her final 10 years increased her personal CBBC factor, her benefit would not be capped with a CBBC factor of 6.25.

Younger vs. Older Retirement Age

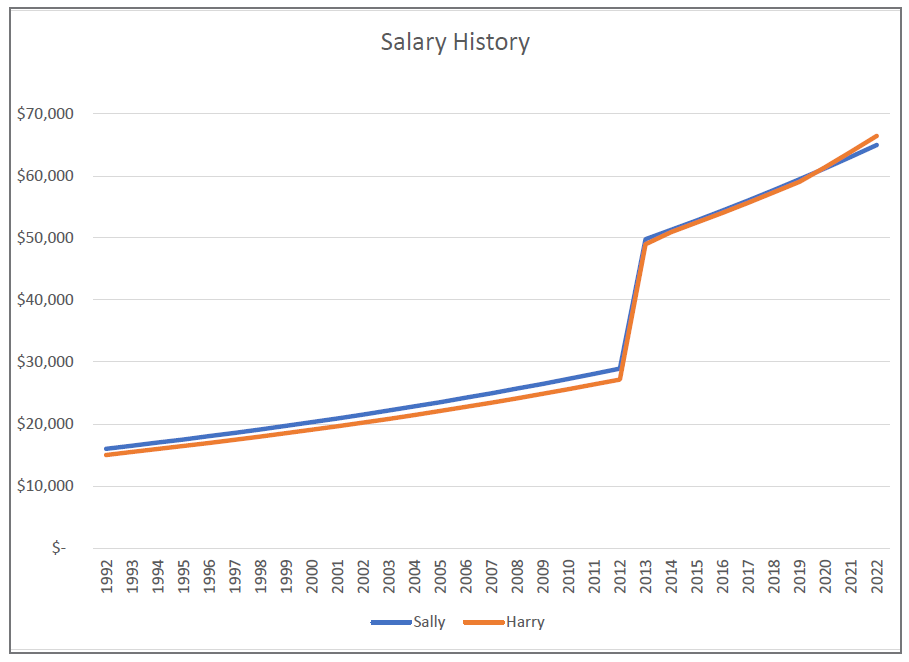

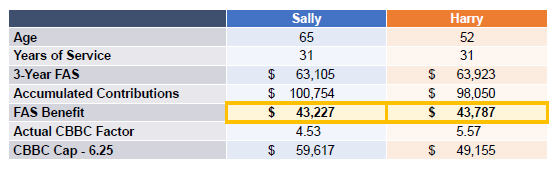

In this scenario, we have one member, Sally, who started her career at 35. Harry started his career at 22. They both work the same number of years with similar salaries. While they both worked 31 years, Harry retired at 52, as he was grandfathered under the previous retirement eligibility rules.

With Harry’s young retirement, his accumulated contributions would be paid back over more years resulting in a higher personal CBBC factor; however, it would not have been capped with a CBBC factor of 6.25.

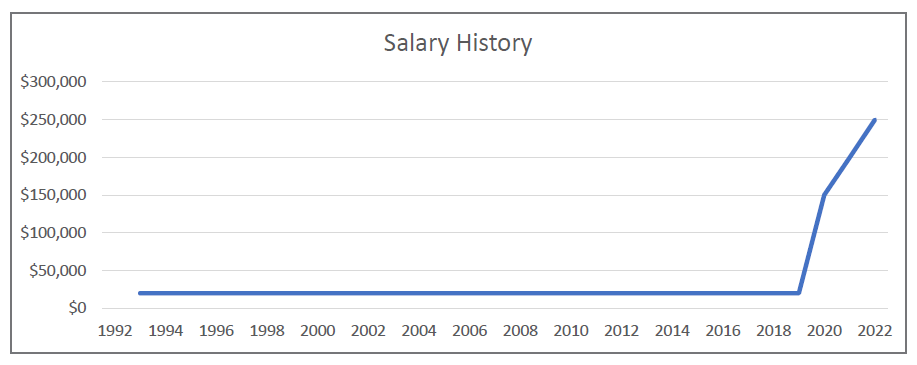

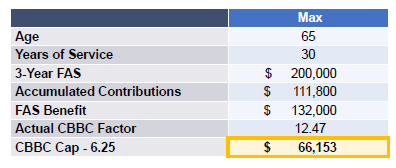

Late Career Salary Boost

Max contributes on a salary in the lower to mid-20’s his first 27 years, but Max’s salary increases drastically during his last three years of service to a quarter-million dollars. This results in a Formula Benefit for Max that exceeds his accumulated contributions in one year. The CBBC ensures Max’s benefit is more consistent with his earnings history.

Overview

A member’s CBBC factor at retirement can be influenced by a variety of elements such as the timing of bonuses, above market salary increases, part-time work, and/or career changes. All these scenarios individually or combined have the potential to impact a member’s Formula Benefit. While several of these scenarios resulted in elevated personal CBBC factors, none of them exceed a CBBC of 6.25. Only the egregious salary increases included in the Late Career Salary Boost scenario produced a CBBC factor greater than 6 for the scenarios included in this analysis.

Where Can I Find My Accumulated Contributions?

For your most up-to-date accumulated contributions, you can log in to your Account Login at any time. Just navigate to the “Member Account” screen and you can find your accumulated contributions under the bolded “Total Account Balance.”

Where Can I Find the CBBC Materials Reviewed by the Board?

The CBBC determination followed years of thorough discussion and careful analysis by SERS’ Board of Trustees. The following materials, as well as those listed on SERS’ Sustainability page, assisted the Board in its decision:

Have a question that’s not answered here? Email us at cbbc@ohsers.org.