Service Credit

SERVICE CREDIT and What it Means to You

Service credit is accrued through contributions during school employment and for other service that may be purchased.

The amount of your service credit determines:

- Your eligibility for retirement or disability benefits

- The amount of your payment

- Your eligibility for health care coverage and the amount of your premium

It also determines the eligibility of your dependents for survivor benefits, the amount of benefits, and availability of health care coverage.

Qualified Service Credit that counts toward SERS health care eligibility:

- Earned or restored

- Contributing service credit from other Ohio retirement systems: CRS, HPRS, OPERS, OP&F, and STRS if not earned at the same time as SERS service credit

- Compulsory

- Leave of Absence

- Military (free and interrupted)

- Optional

- Pregnancy resignation

- School Board

- Workers’ Compensation

Service Credit that does not count toward health care eligibility:

- Early Retirement Incentive (ERI)

- Exempted

- Federal government

- Military (apart from free or interrupted)

- Out of state

- Private school or other school

EARNED SERVICE CREDIT

Contributing Service

You receive service credit for the time you work for a school or college; this is called contributing service credit. One year of service credit is granted upon completion of 120 or more days of paid school employment within a fiscal year (July 1 through the following June 30). There is no distinction between full-time, part-time, or substitute positions in granting this service credit. Any portion of a day constitutes one full day. Paid days that are used, such as sick and vacation, count toward the 120 days.

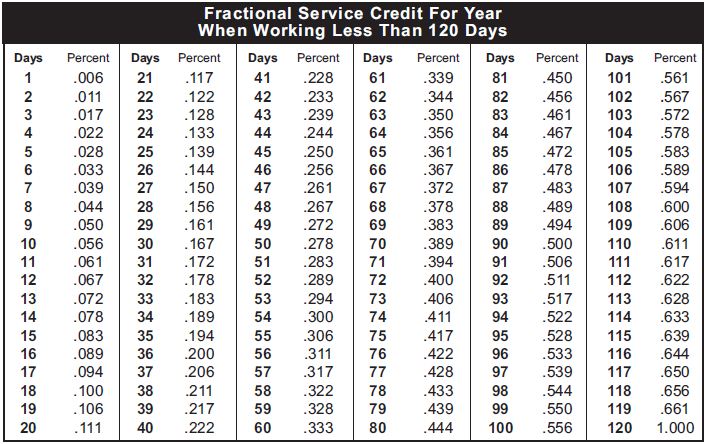

If you work less than 120 days, you will receive a fractional amount of service credit prorated on the basis of a 180-day school year:

Other Ohio Retirement Systems

It is possible to combine other Ohio retirement system accounts with your SERS account?

If you are a member of more than one retirement system at the time of retirement, including the Ohio Public Employees Retirement System (OPERS) or State Teachers Retirement System (STRS), you may have all deposits, salary, and service credit combined for a greater pension.

If you are a member of the Cincinnati Retirement System (CRS), Ohio Highway Patrol Retirement System (HPRS), or Ohio Police and Fire Pension Fund (OP&F), and your contributions are still on deposit, they may be transferred to SERS, including any amounts paid for military service, prior to retirement.

State Teachers Retirement System (STRS) and Ohio Public Employees Retirement System (OPERS)

If you have been employed in a job covered by STRS or OPERS as well as in a job covered by SERS, at retirement you may retire independently from each of the systems if you are eligible or you may combine your service credit and accounts in all the systems to receive one benefit. The system with the greatest service credit is the system that will calculate and pay your benefit. While your salaries in one year are added together, if you have service credit in each system for the same year, you cannot be credited with more than one year of service credit for each 12 months in a year. You also may combine service credit and accounts for a disability benefit.

If you are still working in more than one retirement system at the time of retirement, please see our Reemployment section for information on how reemployment in a public sector position may affect your pension and health care coverage.

Cincinnati Retirement System (CRS)

Credit may be purchased for former service covered by CRS. If your contributions in CRS are still on deposit, they may be transferred to SERS, including any amounts paid for the purchase of military service. If you withdrew the contributions, you may purchase the CRS time after contributing to SERS for 18 months. Your cost for each year is an amount equal to the amount refunded by CRS for your contributing service and any purchased military service, plus the amount of interest, if any, you received when the refund was paid.

![]()

Ohio Police and Fire Pension Fund (OP&F) and Ohio Highway Patrol Retirement System

Credit may be purchased for former service as an Ohio firefighter, police officer, or highway patrol officer. If your contributions in the other system are still on deposit, they may be transferred to SERS including any amounts paid for the purchase of military service. If you withdrew the contributions, you may purchase the OP&F or HPRS time. Your cost for each year is an amount equal to the amount refunded by the other system for your contributing service and any purchased military service, plus interest from the date of the refund to the date of payment.

FREE SERVICE CREDIT

Workers’ Compensation

You may receive additional service credit at no cost for periods you received Workers’ Compensation. If you were off the payroll due to a school-related injury and received Workers’ Compensation, you could receive up to three years of service credit for this time with proof of award history.

![]()

Disability

Disability recipients who return to contributing service at least two years after their disability terminates will be granted up to two years of free disability-period service credit. However, they will be allowed to purchase service credit for the remaining period of disability.

Free Military

If you were a SERS member for at least one year, left school employment for active duty in the armed forces, and returned to public service covered by SERS, STRS, or OPERS within two years of a honorable discharge, you can obtain up to 10 years of free military service credit. You must submit a copy of your discharge or certificate of service notice. Duty in the armed forces includes active duty in the: Army, Navy, Air Force, Marine Corps, and Coast Guard; duty in auxiliary corps as established by Congress, Army and Navy nurse corps, Red Cross nurses serving with the Army, Navy, Air Force, or U.S. hospital service, full-time service with the American Red Cross in a combat zone; or duty in the military national guard and reserve units called to active duty. This service cannot be added if it is or will be used in any other retirement program except Social Security.

PURCHASABLE SERVICE CREDIT

Once you earn at least 1.50 years of contributing service credit, you may qualify to purchase additional service credit.

If you qualify to purchase other types of service credit, SERS will send you a statement for the cost of the credit. You can purchase all or a part of the service credit by making payments directly to SERS in one or more installments, or by payroll deduction, if your employer offers this type of payment plan.

Under a payroll deduction plan, your payments are deducted based on your payroll cycle. Due to federal tax law, once you select this method of payment you cannot change it until the purchase for all the credit is completed.

You also can purchase allowable service credit with funds rolled over from another qualified plan, such as another employer retirement program [Internal Revenue Code (IRC) 401(a)], an Individual Retirement Account (IRA), an IRC 403(a) annuity, an IRC 403(b) plan, or a governmental Deferred Compensation Program under IRC 457.

All service credit must be purchased before you retire.

![]()

Refunded: If you had previous SERS service credit and received a refund of your contributions for this previous service after you left employment, you may restore this service credit.

In order to purchase this credit, you must have returned to employment covered by SERS, STRS, OPERS, OP&F, or the Ohio HPRS, and earned at least 1.50 years of service credit. The cost of the purchase is the amount of your contributions for the contributing service, and interest from the month of the original refund to the date of payment.

Non-Contributing Service with an SERS-covered Employer

You may purchase credit for service in a position for which you were exempt from SERS’ membership, SERS’ membership was optional, or SERS’ membership was compulsory. The credit must be purchased with the system with which you have the most service credit.

![]()

Exempt: For any service after July 1, 1991, you may purchase credit for service in a position for which SERS’ membership was compulsory, but for which you were permitted to, and did, sign an exemption from membership form. The cost for each year of service credit is 20% of your most recent year’s compensation, if purchased with SERS.

Under certain circumstances, you may purchase STRS or OPERS exempt service credit with SERS. If SERS prepares the estimate, the cost for each year is 20% of your most recent year’s SERS compensation.

You cannot purchase this credit if your compensation for such service was subject to taxes under the Federal Insurance Contributions Act (FICA).

![]()

Optional: For any service before July 1, 1991, you may purchase credit for service in a position for which SERS’ membership was optional, and you did not choose to become a member. Your cost for each year of service credit is an amount equal to your employee contributions in effect at the time plus interest and the employer contributions in effect at the time plus interest.

![]()

Compulsory:

Pre-1991: If you were employed by a school for a period before July 1, 1991, and membership was required, but contributions were not paid, your employer for that service is required to pay the employer contributions in effect at the time, plus interest, and you must pay the employee contributions in effect at the time, plus interest.

Post-1991: If you were employed by a school for a period on or after July 1, 1991, and membership was compulsory, but contributions were not paid, your employer for that service is responsible to pay both the employee and employer contributions in effect at the time, plus interest.

Other Government or School Service

You may purchase credit for service with:

- A public or private school, college, or university in another state, or operated by the federal government, which has been chartered or accredited by the proper government agency

- The federal government, or non-Ohio government employers, if the service in a comparable position in Ohio would have been covered by SERS, STRS, OPERS, OP&F or HPRS

- An Ohio municipal retirement system except the Cincinnati Retirement System

The maximum amount of service credit that may be purchased is the lesser of five years, or the total years of your Ohio service credit. If you combine your SERS service credit with any STRS and/or OPERS service credit you have at retirement, the total amount of service credit is limited to five years among all the systems. The service credit is not available if it is or will be used in another retirement benefit, except for Social Security. For each year of credit, you must pay contributions based on the first year of full-time SERS-covered employment following termination of the service to be purchased, plus interest from the date of SERS membership to the date of payment.

Resignation Due to Pregnancy or Adoption of a Child

If you were required to resign because of pregnancy or adoption of a child, you may purchase service credit for this time.

You must have returned to work by the beginning of the third school year after the resignation and earned a year of contributing service credit after the return to work. You cannot purchase more than a total of two years service credit. For each year of credit, you must pay contributions based on the first year of full-time SERS-covered employment after returning to work, plus interest from the date of the return to work to the date of payment. Your employer at the time of the resignation also must pay the employer contributions and interest.

Military Service

There are several ways to obtain military service credit depending on when you entered the service and returned to public employment.

![]()

Interrupted: If you are not eligible to receive free credit for military service that interrupted your school employment described above, you can purchase up to five years of military service credit.

You must have:

- Worked for a SERS-covered employer and been a SERS member

- Entered the military while still employed

- Returned to work with the same employer within three months of your honorable discharge or release from military service

- Maintained SERS membership

Your cost is only the employee contributions in effect at the time if you had remained on the school’s payroll. Interest is added to the amount of employee contributions. Your employer would pay the employer portion.

Other Military Service

If you are not eligible to receive military service credit either free or for purchase as described above, you can still purchase your military service.

You can purchase up to five years of active duty in the armed forces, and up to an additional five years for time spent as a prisoner of war. If you combine your SERS service credit with any STRS and/or OPERS service credit you have at retirement, the total amount of service credit is limited to five years among all the systems. The cost to you for each year of service credit is an amount equal to what applied to your compensation for the first year of full-time employment covered by SERS, STRS, or OPERS following the end of the military service, plus interest from the date of reemployment to the date of payment. You must send SERS a copy of your discharge (DD Form 214) or separation notice. This service cannot be purchased if it is or will be used in any other retirement program except Social Security or retired pay for non-regular service under 10 U.S.C. 12731-12739, or if you contributed to SERS during the same period of time.

School or Governing Board Member Service

A school board member is a member of a city, local, exempted village, or joint vocational school district board of education, and a governing board member is a member of an educational service center governing board.

If you were a school board member or governing board member before July 1, 1991, you may be eligible to purchase .250 of a year for each year of board service.

You must pay the actual liability for this service credit. It can be purchased no sooner than 90 days before retirement with your retiring system. If this service was at the same time of other SERS service credit, it cannot be purchased.

Leave of Absence

If you were on an school board-approved unpaid Leave of Absence (LOA) from your school employer, you may purchase the LOA credit for this time by paying both the employee and employer contributions, plus interest. A LOA period begins on the first day of the approved leave for which contributions were not made, and ends when the approved leave ends or when the member returns to contributing service, whichever happens first.

Service credit may be purchased for multiple leaves of absence. The total years purchased cannot exceed five years, and the maximum amount of service that may be purchased for a period of leave is two years.

Early Retirement Incentive Program

Your employer may establish an Early Retirement Incentive program (ERI), which allows eligible employees to retire early or increase their service credit for retirement.

Eligible employees are those 57 years or older. Under an ERI, an employer may purchase up to five years of service credit for eligible employees. If an employer has an ERI, the employer notifies all eligible employees of the plan and its requirements.