Medicare Basics

Medicare is health insurance for people who meet the following requirements:

- Age 65 or older

- Under age 65 with certain disabilities

- Any age with end-stage renal disease requiring dialysis or a kidney transplant

Medicare is health insurance for people who meet the following requirements:

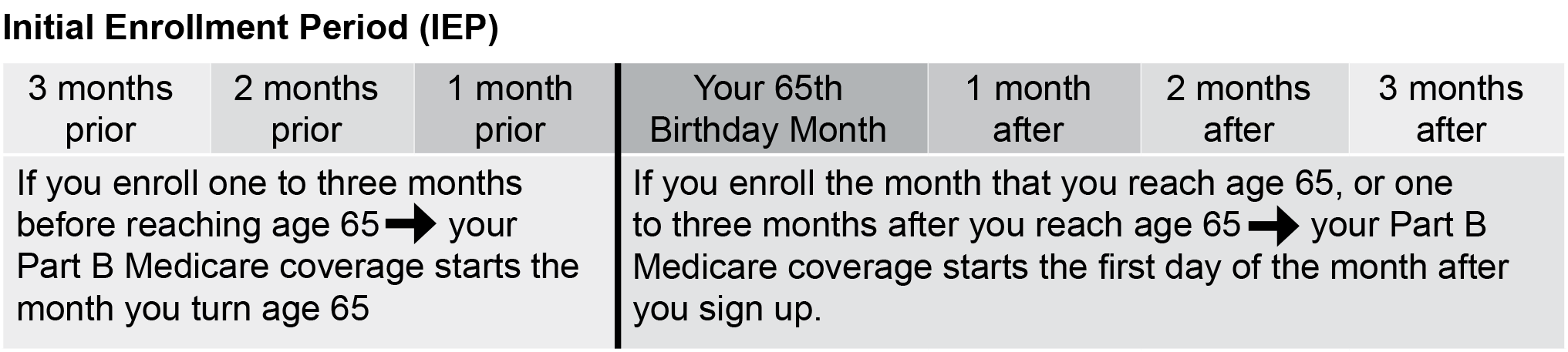

Medicare Initial Enrollment Period

Medicare Initial Enrollment PeriodMedicare charges a lifetime penalty of 10% for each 12-month period you are eligible for Medicare Part B but do not sign up for it.

The penalty does not apply when you are enrolled in an employer health plan. See “Working Past Age 65”.

If you are receiving a Social Security check:

If you are not yet receiving a Social Security check or are not eligible for one:

Medicare Part A – Enroll in premium-free Part A if you are eligible. Eligibility is based on your work record, or a spouse’s or former spouse’s work record. If Social Security says you are not eligible to receive Part A for free, and you are enrolling in the SERS Medicare coverage, do not sign up for Medicare Part A. Your SERS Medicare Advantage plan covers your Part A services.

Medicare Part B – Everyone must enroll in Part B, and everyone pays a monthly premium. Your Part B premium is deducted from a Social Security check, or you pay it directly to Medicare. The 2025 premium for most new enrollees is $185 per month. Social Security’s blog has useful information on how to sign up for Medicare Part B.

If you are covered by an employer health plan, either from your own or your spouse’s current employment, you can delay enrolling in Medicare Parts A and B. When you decide to stop working, you have a one-time Special Enrollment Period of up to eight months after your employer coverage ends to enroll in Medicare.

Call your local Social Security office to schedule an appointment to file your application. It is advisable to request a date-stamped copy of the application for your records.

You will need to enroll in Medicare Part B. You will need to submit to Social Security:

Ask your employer to complete the Request for Employment Information form and return it to you . This form is proof that you delayed your Medicare Part B enrollment because you had employer coverage, and you will not be subject to a late enrollment penalty .

If you have Part A only or receive a Social Security check, you generally cannot file your Medicare application any earlier than 30 days before the month you want your coverage to begin .

Contact your local Social Security office for these forms or download them at www.ssa.gov/forms.

You will need to enroll in Medicare Part A and Medicare Part B . You will need to submit to Social Security the Request for Employment Information (CMS-L564) form.

Ask your employer to complete the Request for Employment Information form and return it to you . This form is proof that you delayed your Medicare Part B enrollment because you had employer coverage, and you will not be subject to a late enrollment penalty.

If you have not started receiving Social Security benefits, you can file your application up to three months before you want coverage to begin .

Contact your local Social Security office for this form or download it at www.ssa.gov/forms.

Part A is premium-free for most people, based upon either their own work history or their

spouse’s work history in Social Security.

Everyone is eligible for Part B, and pays a monthly Part B premium. In 2025, the premium for most new enrollees is $185 per month.

For more information, watch the video “Why It’s Important to Pay Your Part B Premium.”

Purchased separately, unless you enroll in a Medicare Advantage plan that includes Part D.

For more information, watch the video “All About Medicare Part D.”

Medicare Coverage Choices

Medicare Coverage ChoicesWhen you become eligible for Medicare, you have a choice to make on how to receive your coverage:

Original Medicare or a Medicare Advantage Plan

For more information, watch the video “Your Medicare Coverage Choices.”

Approaching 65 and SERS’ Medicare Coverage

Approaching 65 and SERS’ Medicare CoverageThose eligible for SERS’ health care coverage will receive an “Approaching 65” packet three months before turning 65. This packet will contain information on Medicare enrollment and the SERS Medicare Advantage Plan.

Benefit recipients currently enrolled in SERS’ non-Medicare coverage will be switched to the SERS Medicare plan once Medicare proof is received.

Benefit recipients who previously waived SERS’ coverage can enroll by completing the health care application enclosed in their packets and providing Medicare proof.

Opportunities to join SERS’ Medicare coverage are limited. If you decline coverage when you are Medicare eligible or switch to another individual Medicare plan, you will not be able to enroll in the future.

Medicare Part B Reimbursement

Medicare Part B ReimbursementSERS retirees who are eligible for Medicare Part B and enrolled in SERS’ health care coverage are eligible to receive a Medicare Part B reimbursement. You must have SERS coverage to receive this benefit.

SERS currently reimburses eligible benefit recipients $45.50 per month to help pay Medicare Part B premiums. If your Medicare Part B coverage is cancelled, or your Part B premium is paid by any other source, including the Medicare Premium Assistance Program or Medicaid, you are not eligible for the reimbursement.

Reimbursement starts after SERS receives proof of Medicare Part B enrollment. The reimbursement is not retroactive.

Spouses and dependents are not eligible for this reimbursement.