Retirement Basics

When Can You Retire?

When Can You Retire?

As a member of SERS, you have been funding your own retirement through employee contributions, employer contributions, and investment returns on those contributions each pay period.

While the time to retire is unique for each individual, one piece of financial advice that applies to everyone is that the earlier you begin to plan for retirement, the better prepared you will be to enjoy it.

If you’re just starting to think about retirement, read Ten Steps Toward a Secure Retirement. This handout gives some insight into retirement options you want to learn more about as you get closer to retirement.

Retiring from your SERS-Covered Job

Retiring from your SERS-Covered Job

Retirement with SERS is a matter of eligibility. You must meet one of the age and service credit combinations that entitles you to apply for a monthly, lifetime pension.

Several factors determine eligibility for retirement: your date of retirement, your age, and your amount of service credit. Eligibility for retirement through SERS is not the same as eligibility for Social Security. Call Social Security at 1-800-772-1213 for additional information.

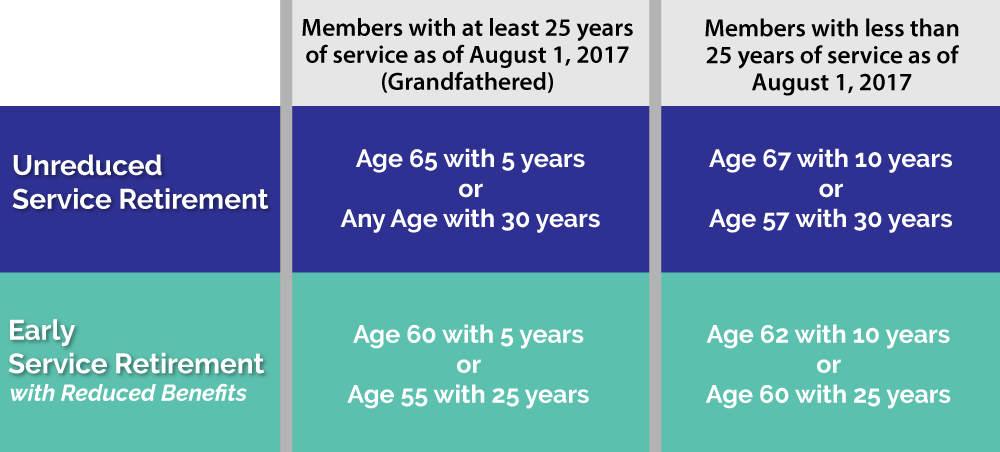

SERS offers two types of service retirement: unreduced service retirement and early service retirement with reduced benefits.

For unreduced service retirement, you will earn the maximum pension amount based on your service credit (how long you’ve worked in an Ohio public service job), and final average salary (the average of the three highest years of salary). Early service retirement benefits will be reduced to cover the cost of providing a pension over a longer period of time.

SERVICE RETIREMENT ELIGIBILITY REQUIREMENTS

Leaving Your SERS Job and Retiring Later

Leaving Your SERS Job and Retiring Later

In some instances, school employees leave employment before reaching eligibility age, and do not file for service retirement until reaching age 62 or 65, thinking they should apply at the same time they file for Social Security benefits. Please refer to the above table to determine your first eligible date.

The first payment includes all payments due from the time you first become eligible to retire. However, health care coverage cannot be retroactive. Therefore, it is best to apply for your retirement when you are first eligible. When filing for a retroactive retirement, we suggest you contact Social Security to determine any possible adjustments.

If You Have Multiple Jobs

If you have more than one job with a SERS employer, you may retire from the highest-paying position and continue working in the lower-paying job(s). For example, if you are a custodian and a bus driver, and have two distinct salaries, those salaries will both be used in the calculation of your pension, and you can keep working in the lowest-paying job after you retire. You must have distinct salaries or individual contracts, or work for more than one SERS employer to do this.

If you work under Ohio Public Employees Retirement System (OPERS) or State Teachers Retirement System (STRS) in addition to SERS, you might be able to retire from the highest-paying position and continue in the lower-paying job. If you continue in the lower-paying position after you retire, you will be a reemployed retiree. Your original pension will not be affected by continuing to work in this lower-paying position. See the Member Benefits Guide for more details.

AGE + SERVICE CREDIT + SALARY = PENSION

Once you have determined whether or not you are eligible to retire, you will probably want to know how much your pension will be and how it is figured.

Your pension is based on age, service credit, and salary.

The age used in a pension calculation is your actual age at the time you retire. If you plan to retire July 1, but your birthday is July 15, it may be to your advantage to postpone your retirement date until August 1. However, one month’s delay means one pension check lost. It may not be worth it.

Only a comparison of the “before” and “after” estimates will supply the answer.

All of your service credit is used in calculating your pension. All service credit must be purchased before your retirement date. Our Member Services staff can show you the pension amount before and after purchase of credit. In some cases, you can recover the cost of a purchase in two or three years by receiving a higher pension amount.

For more information on purchasing credit, see the Service Credit page.

If you want SERS to send you an estimate of your payment, you must choose an actual retirement date, such as July 1, 2022. Even though this date may only be tentative, a date is necessary for calculating the correct age, service credit, and final average salary (highest three years of salary).

SERS will review your file, and send an estimate to you. In some cases, additional estimates will be included to help you determine your best options. The amounts given are meant only to provide you with an estimate of your pension and probably will differ slightly from the actual pension you receive at retirement.

If you would like an estimate, you can contact our office at 1-800-878-5853, or you can create estimates using Account Login. After you create your account, select “Estimates” from the left hand menu.

Helpful Hints to Consider:

- If you are a 12-month employee that works 5 days per week and receives credit for 120 days, you could retire January 1.*

- If you are a nine-month employee that works 5 days per week and receives credit for 120 days, you could retire March 1.*

- If you are a nine-month employee and receive “stretch pay” throughout the summer, you could retire July 1, rather than September 1.

- If you are under age 67 and have less than 30 years of service, retiring after your next birthday may increase your pension.

- Read The Top 10 Things You Should Know about Your SERS Retirement

*Please be aware that working less than 5 days per week will reduce your service credit.

CALCULATING YOUR OWN PENSION

Estimating what your pension will be before you retire helps you make an informed decision about when to retire.

You can create an online account and estimate your pension. Go to Account Login, and after you create your account, select “Estimates” from the menu.