Contribution Reporting

Contribution Reports

The Contribution Report is the employer’s responsibility. It details the employees for whom you report and remit contributions.

This report must be submitted to SERS no later than five business days after each pay date in eSERS. Penalties will be assessed for late contribution reports.

Submitting Reports

Contribution Reports must be submitted through eSERS, using either Manual Contribution Entry or Upload Contribution Files in the required format.

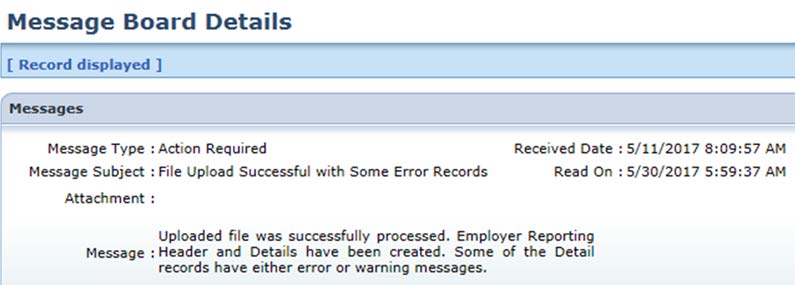

Once your Contribution Report has been uploaded and processed, you will receive a message on the message board in eSERS. The message indicates if the report has been successfully processed and posted, or if it has been successfully processed with either errors or warnings.

If the file is processed with errors or warnings, you need to correct the issues identified on the Contribution File Correction and Manual Contribution Entry application in eSERS. Once all records are valid, you will be able to submit the file for posting.

Please refer to the eSERS Guide for further information on how to correct your report.

The “Uploaded file was successfully processed and posted” message looks like this:

The “Uploaded file was successfully processed with either error or warnings” message looks like this:

Sending a Report

To send a Contribution Report, you need the following:

- Contribution Cycle Code – created by the Payroll Schedule

- Social Security number and name for your employee(s)

- Period Begin Date – beginning date of earnings

- Period End Date – ending date of earnings

- Earnings Code – identifies the type of contributions that are being reported

- Covered Compensation – the employee’s gross covered compensation for SERS purposes

- Contributions – the amount of employee contributions being remitted to SERS

- Days – the number of days the employee is being paid for the period

- Hours – the number of hours the employee is being paid for the period

If the contributions are post-tax, the amount is placed in the “Employee Post-Tax Contribution” field.

If the contributions are covered by an authorized and accepted employer Pick-up Plan as pre-taxed, the amount is placed in the “Employee Pre-Tax Contribution” field.

Be sure to verify with contract companies if contributions are pre-tax or post-tax. Accuracy is vital for tax purposes.

How to Report Days and Hours

A day is any part of a day for which the employee is paid, whether for work or paid time off. This includes holidays, vacation, sick or personal leave, calamity days, and paid work on a weekend.

- Report only days which have been paid in the pay cycle that is being reported.

- Days worked in one pay cycle but paid in the following pay cycle should be reported on the next contribution report.

- The days worked cannot exceed the number of days in the payroll schedule.

- Report only hours that have been paid in the pay cycle that is being reported.

- Hours worked one pay cycle but paid in the following pay cycle should be reported on the next contribution report.

Exception: There is a Supplemental Earnings Code for your coaches or supplemental employees that allows their contributions to be reported on a regular payroll report with extra days and hours. This only works if you are using the same pay date in eSERS.