Retirement Basics

When Can I Retire?

Now that you are a member of SERS, you have begun funding your own retirement through employee contributions, employer contributions, and investment returns on those contributions.

SERS’ mission is to provide its members, retirees, and beneficiaries with pension benefit programs and services that are soundly financed, prudently administered, and delivered with understanding and responsiveness.

A SERS pension provides lifetime retirement security in the form of regular and consistent benefit payments, which makes it easier for retirees stay on a budget.

Retirement with SERS is a matter of eligibility. You must meet one of the age and service credit combinations to be eligible for a monthly, lifetime pension. Your pension is determined by your age, the amount of service credit you have earned, and your final average salary, which is the average of your three highest years of salary.

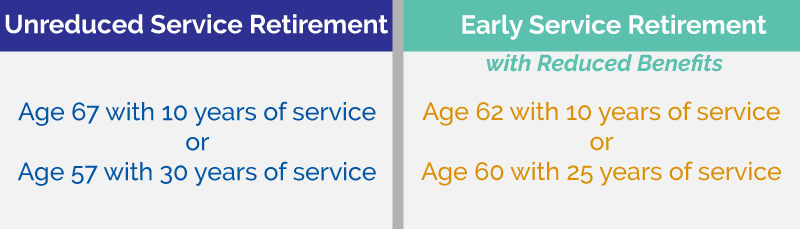

SERS offers two types of service retirement: unreduced service retirement and early service retirement with reduced benefits. For unreduced service retirement, you will earn the maximum pension amount based on your service credit and final average salary. Early service retirement benefits will be reduced to cover the cost of providing a pension over a longer period of time.

Service Retirement Eligibility

When you decide to retire, you’ll be able to choose:

When you decide to retire, you’ll be able to choose:

- The payment plan that works best for you and your family

- Who should be your beneficiary

- A SERS health care plan (if you have 10 or more years of qualified service credit)

These are just a few of the decisions you’ll have to make. For more details about retirement options that are available today, please read the Member Benefits Guide.