Employer Statement and Surcharge Report Available on eSERS

Both Due No Later than August 26, 2025

Employer Statement

The Employer Statement includes contribution and payment detail for the 2025 fiscal year as posted through July 18, 2025. Any activity for fiscal year 2025 received after July 18, 2025, is posted to next year’s statement.

Any amount due to SERS must be paid by August 26, 2025.

Remember:

- This includes any “Employee Activity” amount

- No balances are carried forward

- The Foundation Program is not used to pay Employer Statements

For instructions on how to read your statement and make a payment, refer to the How To: Employer Statement.

Surcharge Report

Your Surcharge calculations are complete. The summary information for the most recent fiscal year is displayed, including the invoice amount after all adjustments.

Unless your district is paying the Surcharge through the Foundation Program, payments are due no later than August 26, 2025.

If you are unsure whether your district pays through the Foundation Program, refer to your Foundation Deduction Letter, which also is found on eSERS. For more information, refer to the Employer Services Fact Sheet Surcharge.

Payment Remittance Required with Employer Statement and Surcharge

A payment remittance is required to be completed with your Employer Statement and Surcharge via eSERS. If you have questions, email Employer Services or call 1-877-213-0861.

Any amount not received by August 26, 2025, will be considered late and will be subject to a penalty.

If paying by check, your payment must be mailed to the SERS lockbox. Do not mail Employer Statement and Surcharge payments to the SERS building. Mail checks to the SERS lockbox at:

SERS L-1617

Columbus, Ohio 43260-1617

Expedited payments to the bank for lockbox processing must be delivered prior to 11 a.m. for same day processing to:

Huntington National Bank

7 Easton Oval

Attention: Wholesale Lockbox L-1617

Columbus, Ohio 43219

Bank Account Maintenance: Electronic Refund Option

Last year, SERS implemented an electronic refund option.

If a district would like its refund to be issued electronically, SERS will deposit the refund into the account specified.

If your Employer Statement reflects “Amount Due to District,” the district can add the Refund Account option to one of the checking/savings accounts on file to receive an electronic refund from SERS. This must be done prior to the issuance of the refund to the district.

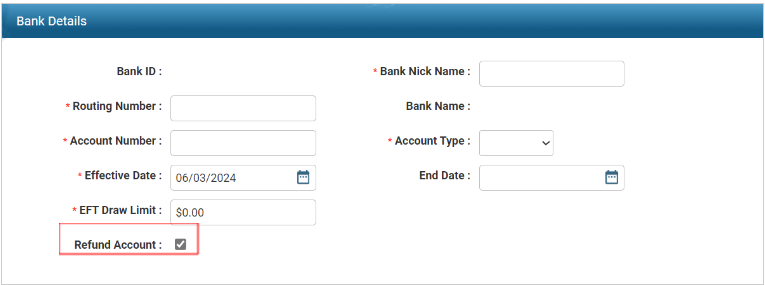

The Employer Web Administrator (EWA) has to check the ‘Refund Account’ box in the designated account on eSERS to receive a refund via ACH Credit. Only one bank account can be selected for this option.

For instructions on how to add this option to your bank account, refer to the eSERS Guide: Bank Account Maintenance.

If your district has already selected an account to be a “refund account” and your Employer Statement reflects “Amount Due to District,” the refund amount will automatically be deposited into that specific account.